Comparing linear and Additive logistic regression

Library setup

Read in the data

| X | purchase | n_acts | bal_crdt_ratio | avg_prem_balance | retail_crdt_ratio | avg_fin_balance | mortgage_age | cred_limit |

|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 11 | 0.000 | 2494.414 | 0.000 | 1767.197 | 182.00 | 12500 |

| 2 | 0 | 0 | 36.095 | 2494.414 | 11.491 | 1767.197 | 138.96 | 0 |

| 3 | 0 | 6 | 17.600 | 2494.414 | 0.000 | 0.000 | 138.96 | 0 |

| 4 | 0 | 8 | 12.500 | 2494.414 | 0.800 | 1021.000 | 138.96 | 0 |

| 5 | 0 | 8 | 59.100 | 2494.414 | 20.800 | 797.000 | 93.00 | 0 |

| 6 | 0 | 1 | 90.100 | 2494.414 | 11.491 | 4953.000 | 138.96 | 0 |

clean up the data

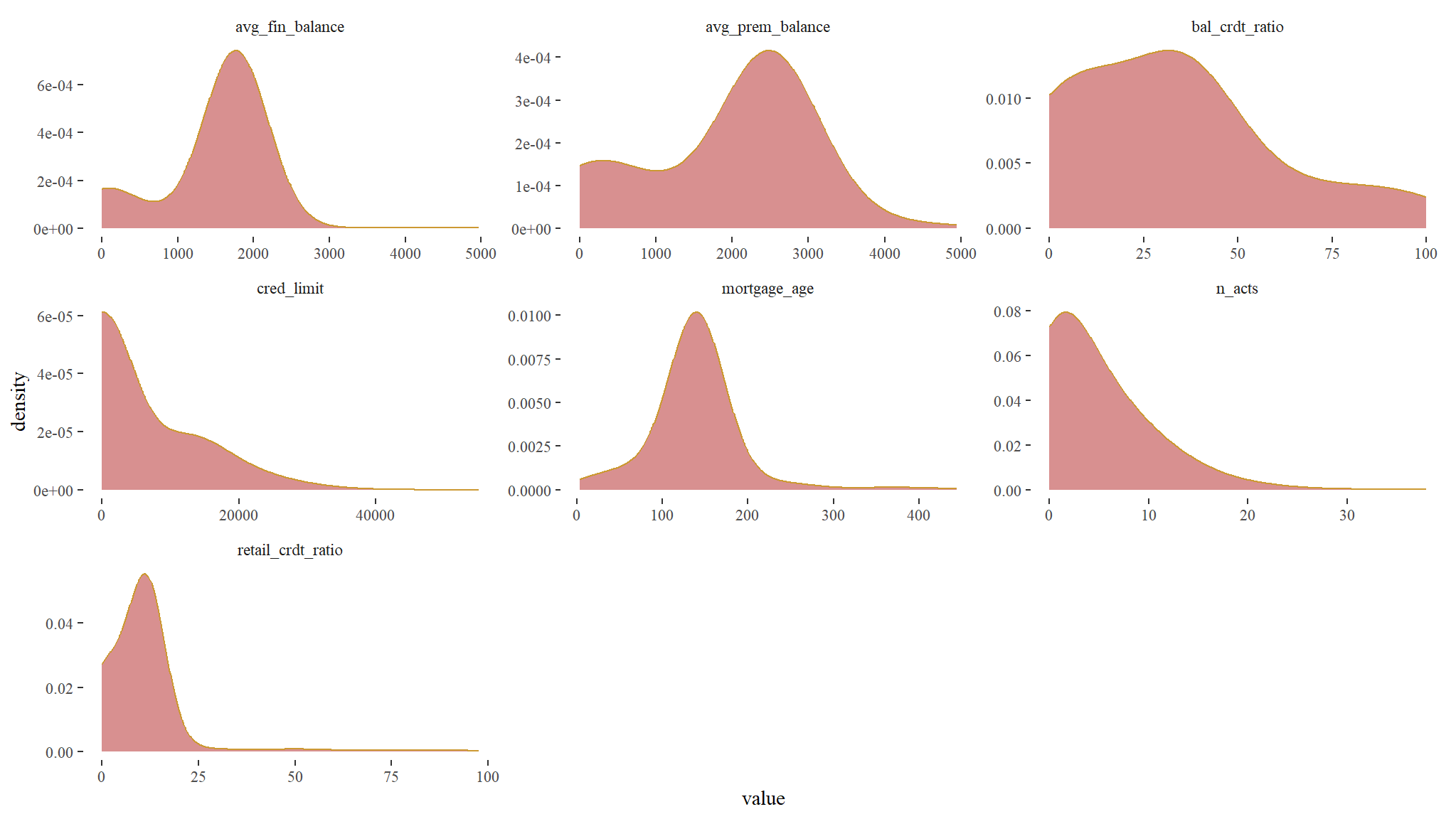

look at the distribution of the data

csale_clean |>

select_if(is.numeric) |>

gather() |>

ggplot(aes(value)) +

geom_density(adjust = 3, col = "#CC9933", fill = "firebrick", alpha = 0.5) +

facet_wrap(~key,scales="free")+

theme(axis.text.x = element_text(angle = 60))+

theme_tufte()

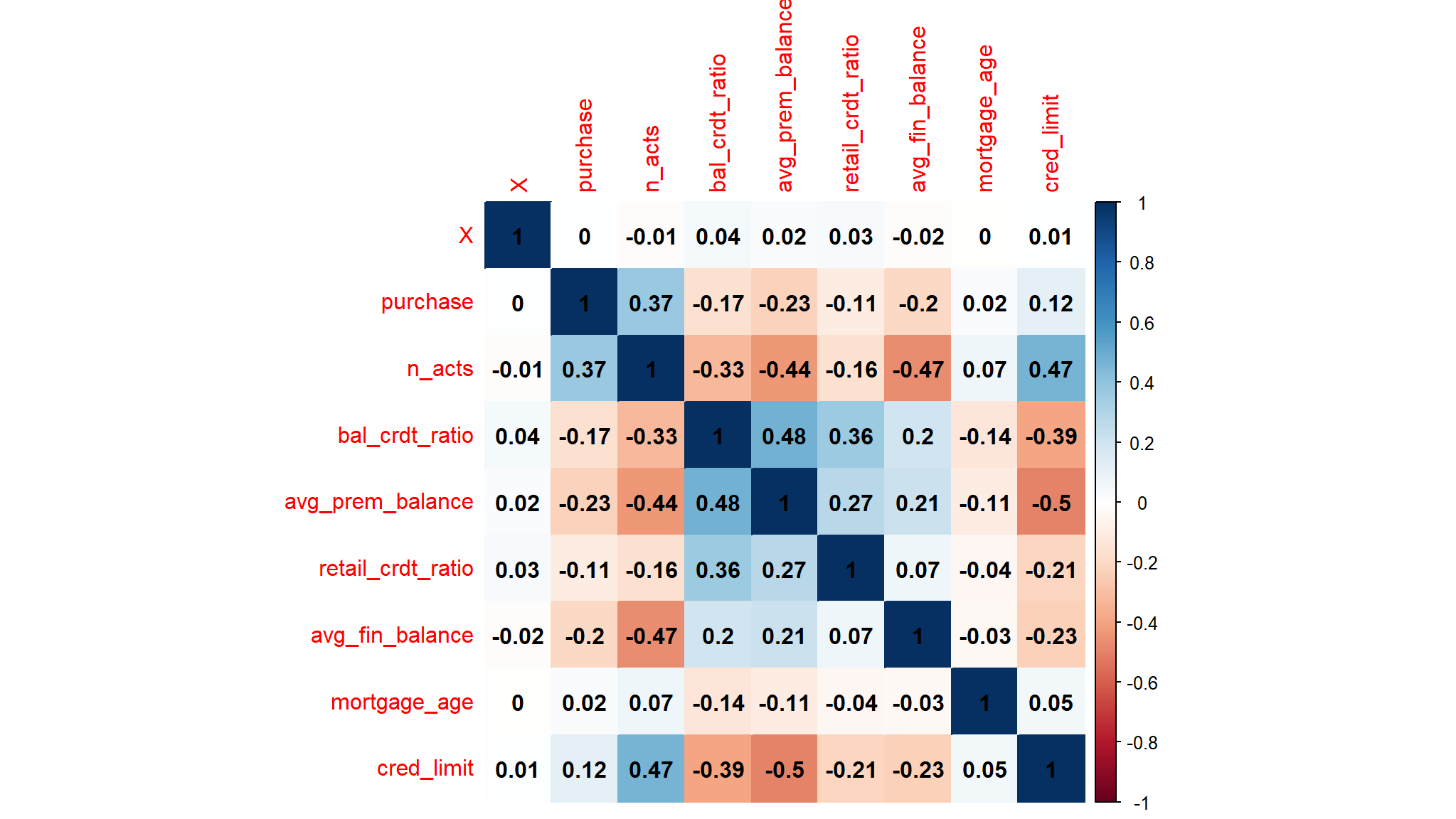

correlation

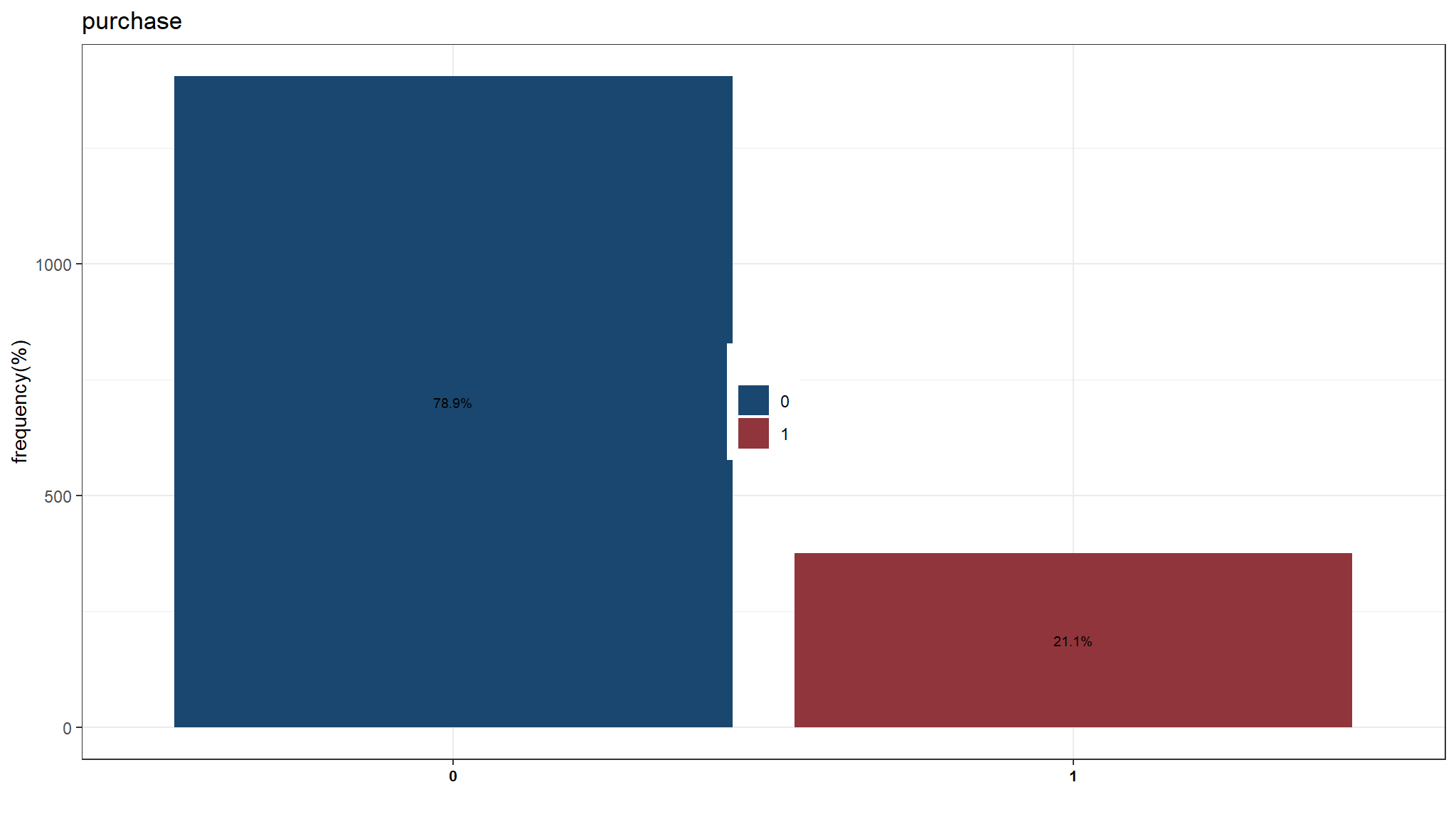

Initial model development

GLM logistic

# Fit a logistic model

log_mod_glm <- glm(purchase ~ mortgage_age, data = csale,

family = binomial)

summary(log_mod_glm)

#>

#> Call:

#> glm(formula = purchase ~ mortgage_age, family = binomial, data = csale)

#>

#> Coefficients:

#> Estimate Std. Error z value Pr(>|z|)

#> (Intercept) -1.46292 0.16659 -8.781 <2e-16 ***

#> mortgage_age 0.00103 0.00112 0.919 0.358

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> (Dispersion parameter for binomial family taken to be 1)

#>

#> Null deviance: 1832.4 on 1778 degrees of freedom

#> Residual deviance: 1831.6 on 1777 degrees of freedom

#> AIC: 1835.6

#>

#> Number of Fisher Scoring iterations: 4AIC(log_mod_glm)

#> [1] 1835.554GAM logistic

# Fit a logistic model

log_mod_gam <- gam(purchase ~ s(mortgage_age), data = csale,

family = binomial,

method = "REML")

summary(log_mod_gam)

#>

#> Family: binomial

#> Link function: logit

#>

#> Formula:

#> purchase ~ s(mortgage_age)

#>

#> Parametric coefficients:

#> Estimate Std. Error z value Pr(>|z|)

#> (Intercept) -1.34131 0.05908 -22.7 <2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Approximate significance of smooth terms:

#> edf Ref.df Chi.sq p-value

#> s(mortgage_age) 5.226 6.317 30.02 4.11e-05 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> R-sq.(adj) = 0.0182 Deviance explained = 1.9%

#> -REML = 910.49 Scale est. = 1 n = 1779AIC(log_mod_gam)

#> [1] 1811.976anova(log_mod_glm,log_mod_gam,test="LRT")

#> Analysis of Deviance Table

#>

#> Model 1: purchase ~ mortgage_age

#> Model 2: purchase ~ s(mortgage_age)

#> Resid. Df Resid. Dev Df Deviance Pr(>Chi)

#> 1 1777.0 1831.5

#> 2 1772.8 1797.6 4.2261 33.963 9.982e-07 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1- the AIC already suggests that a logistic model under a

GAMis better than that in aGLM - The anova test also suggests that a model with a smooth term performs better than the one without

fit a full model

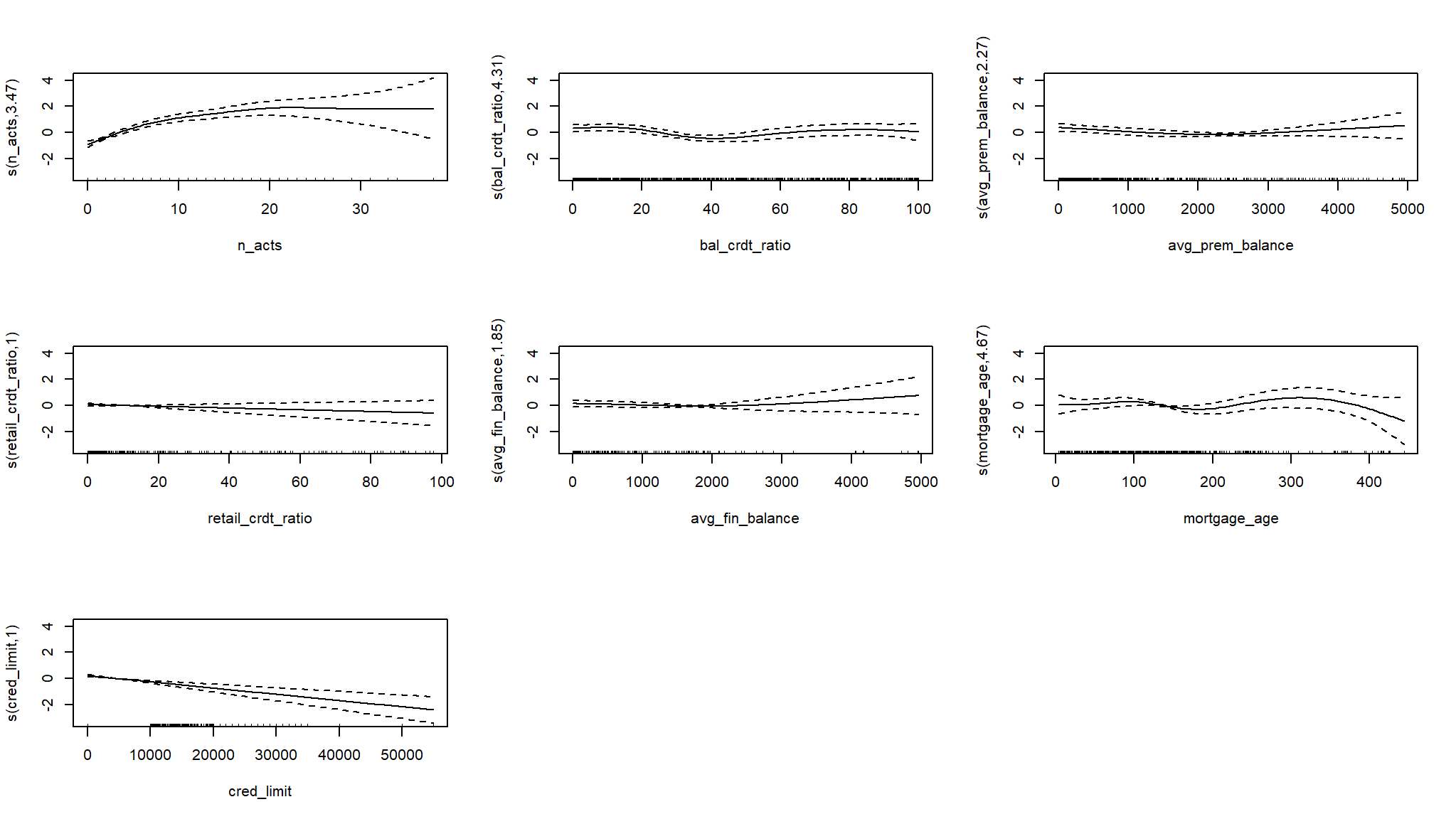

GAM logistic

# Fit a logistic model

log_mod_gam2 <- gam(purchase ~ s(n_acts) + s(bal_crdt_ratio) +

s(avg_prem_balance) + s(retail_crdt_ratio) +

s(avg_fin_balance) + s(mortgage_age) +

s(cred_limit),

data = csale,

family = binomial,

method = "REML")

# View the summary

summary(log_mod_gam2)

#>

#> Family: binomial

#> Link function: logit

#>

#> Formula:

#> purchase ~ s(n_acts) + s(bal_crdt_ratio) + s(avg_prem_balance) +

#> s(retail_crdt_ratio) + s(avg_fin_balance) + s(mortgage_age) +

#> s(cred_limit)

#>

#> Parametric coefficients:

#> Estimate Std. Error z value Pr(>|z|)

#> (Intercept) -1.64060 0.07557 -21.71 <2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Approximate significance of smooth terms:

#> edf Ref.df Chi.sq p-value

#> s(n_acts) 3.474 4.310 93.670 < 2e-16 ***

#> s(bal_crdt_ratio) 4.308 5.257 18.386 0.00319 **

#> s(avg_prem_balance) 2.275 2.816 7.800 0.04889 *

#> s(retail_crdt_ratio) 1.001 1.001 1.422 0.23343

#> s(avg_fin_balance) 1.850 2.202 2.506 0.27889

#> s(mortgage_age) 4.669 5.710 9.656 0.13356

#> s(cred_limit) 1.001 1.002 23.066 2.37e-06 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> R-sq.(adj) = 0.184 Deviance explained = 18.4%

#> -REML = 781.37 Scale est. = 1 n = 1779AIC(log_mod_gam2)

#> [1] 1542.598

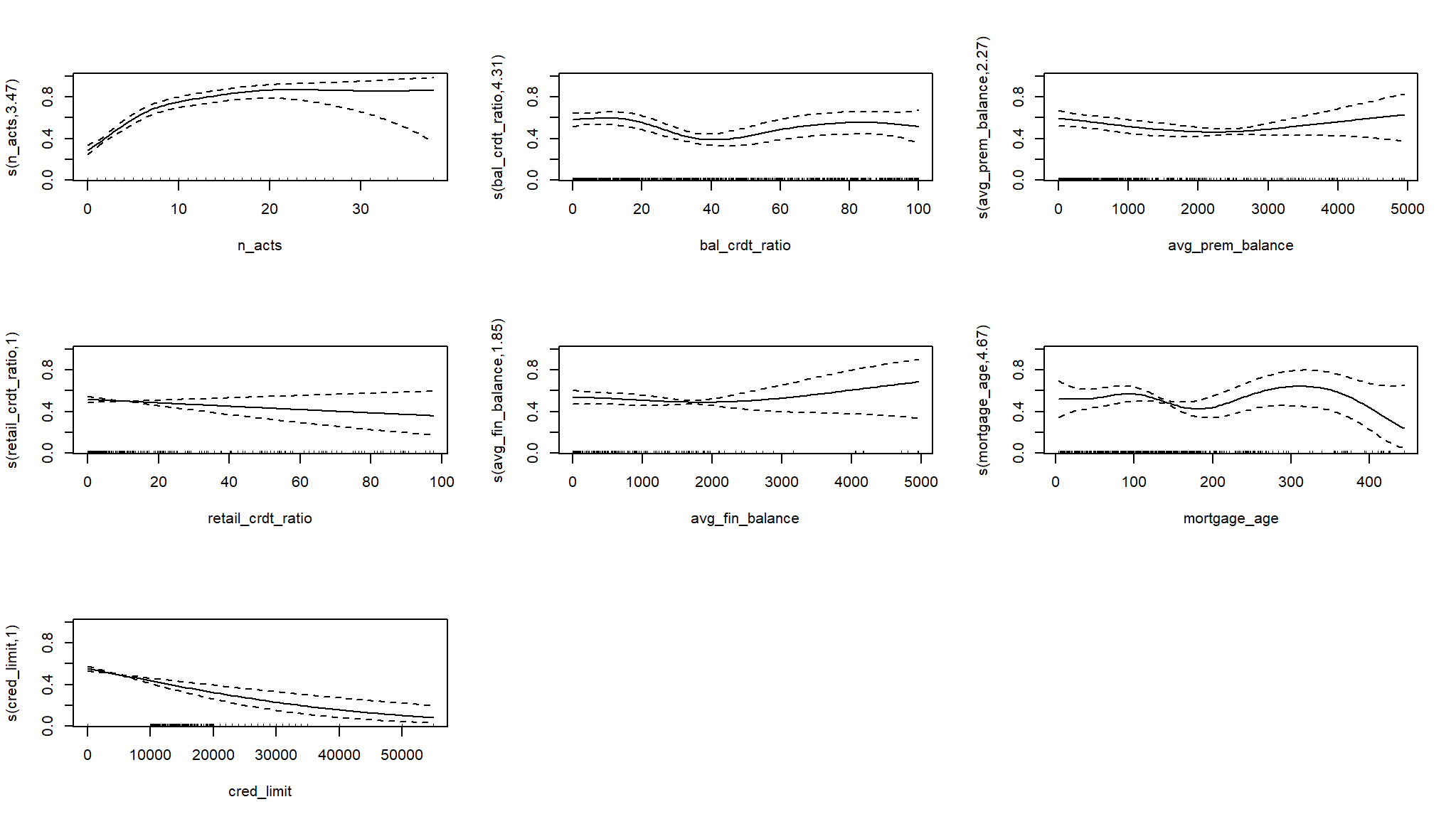

# Plot on the log-odds scale

plot(log_mod_gam2, pages = 1)

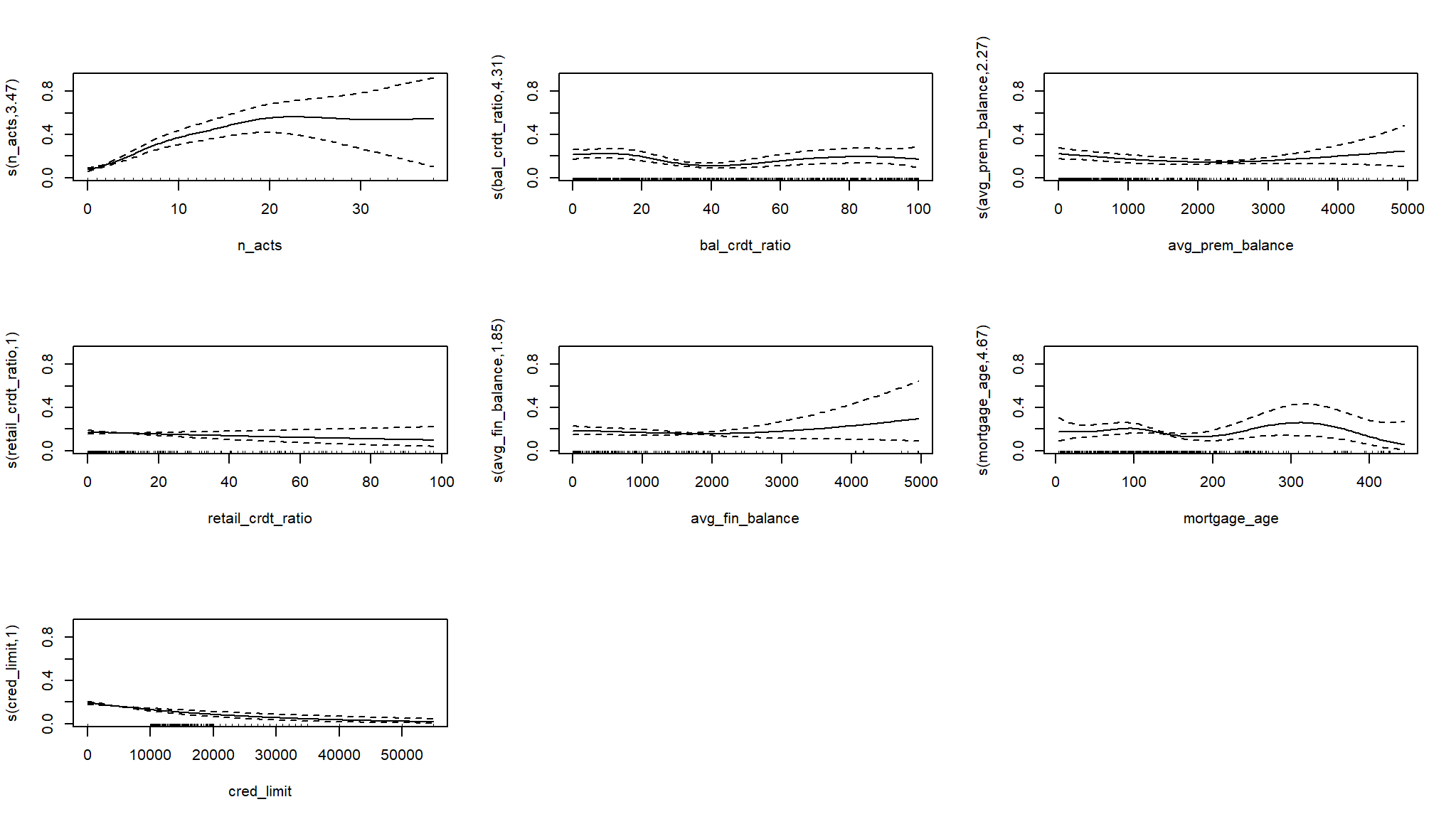

# Plot on the probability scale

plot(log_mod_gam2, pages = 1, trans = plogis)

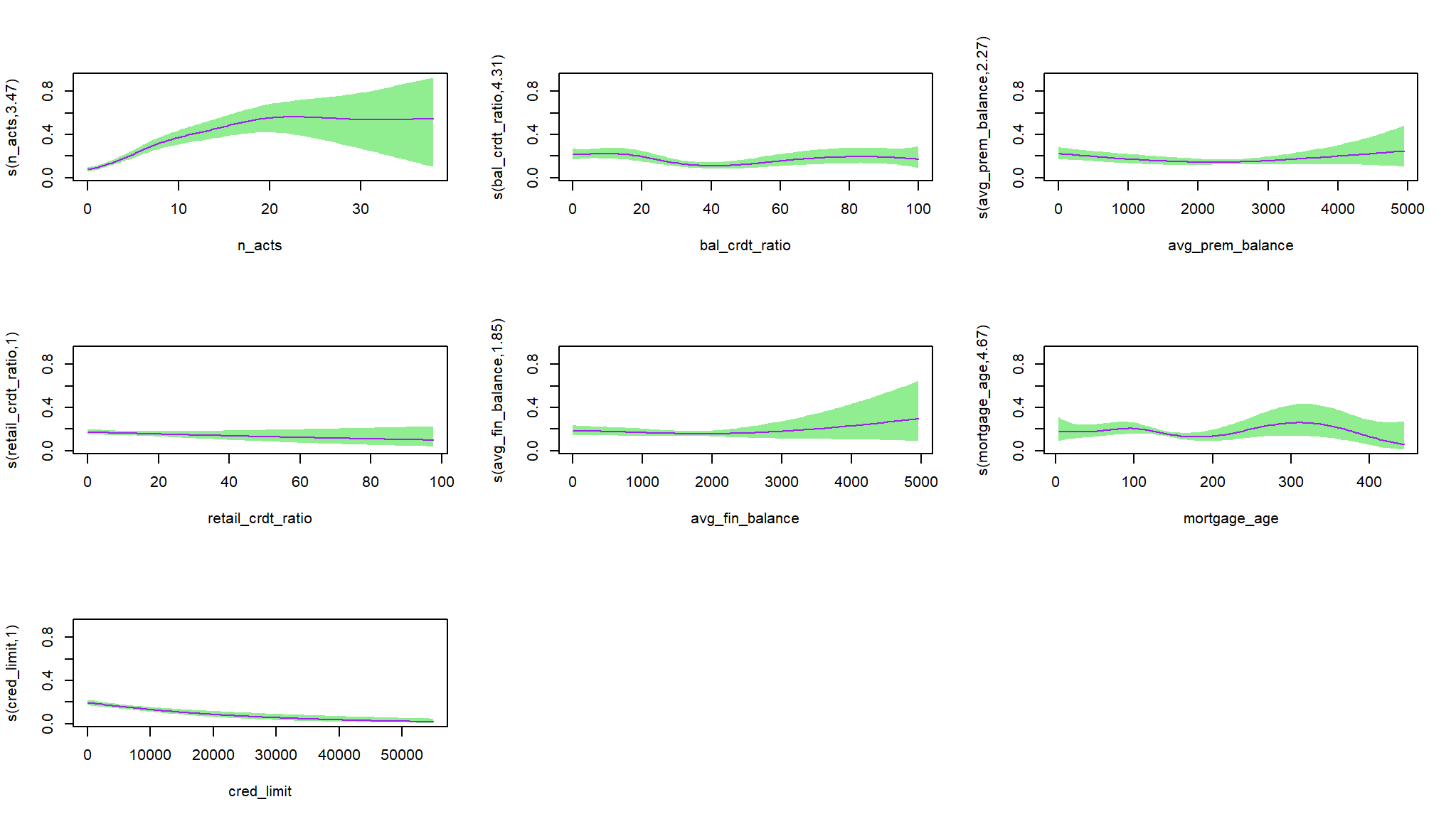

# Plot with the intercept

plot(log_mod_gam2, pages = 1, trans = plogis,

shift = coef(log_mod_gam2)[1])

# Plot with intercept uncertainty

plot(log_mod_gam2, pages = 1, trans = plogis,

shift = coef(log_mod_gam2)[1], seWithMean = TRUE,

rug = FALSE, shade = TRUE, shade.col = "lightgreen" , col = "purple")

GLM logistic

log_m <- glm(purchase ~ n_acts + bal_crdt_ratio +

avg_prem_balance + retail_crdt_ratio +

avg_fin_balance + mortgage_age +

cred_limit,

data = csale,

family = binomial)

summary(log_m)

#>

#> Call:

#> glm(formula = purchase ~ n_acts + bal_crdt_ratio + avg_prem_balance +

#> retail_crdt_ratio + avg_fin_balance + mortgage_age + cred_limit,

#> family = binomial, data = csale)

#>

#> Coefficients:

#> Estimate Std. Error z value Pr(>|z|)

#> (Intercept) -1.052e+00 2.901e-01 -3.628 0.000285 ***

#> n_acts 1.483e-01 1.467e-02 10.109 < 2e-16 ***

#> bal_crdt_ratio -4.485e-03 3.003e-03 -1.493 0.135310

#> avg_prem_balance -2.335e-04 7.006e-05 -3.333 0.000860 ***

#> retail_crdt_ratio -6.247e-03 5.916e-03 -1.056 0.291052

#> avg_fin_balance -1.157e-04 9.104e-05 -1.271 0.203606

#> mortgage_age -8.033e-04 1.134e-03 -0.709 0.478596

#> cred_limit -3.718e-05 9.579e-06 -3.881 0.000104 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> (Dispersion parameter for binomial family taken to be 1)

#>

#> Null deviance: 1832.4 on 1778 degrees of freedom

#> Residual deviance: 1580.0 on 1771 degrees of freedom

#> AIC: 1596

#>

#> Number of Fisher Scoring iterations: 4AIC(log_m)

#> [1] 1596.011- again the GAM logistic performs better with a much smaller

AIC

Lets see how these compare on new predictions

set up data for modeling

set up a recipe

train_rcp <- recipe(purchase ~ ., data=csale)

# Prep and bake the recipe so we can view this as a seperate data frame

training_df <- train_rcp |>

prep() |>

juice()Set up engines for different models

initialise a GLM model

log_mod_glm <- logistic_reg() |>

set_engine('glm') |>

set_mode("classification")add to workflow

lr_wf <-

workflow() |>

add_model(log_mod_glm) |>

add_recipe(train_rcp)lr_fit <-

lr_wf |>

fit(data=train)Extracting the fitted data

I want to pull the data fits into a tibble I can explore. This can be done below:

lr_fitted <- lr_fit |>

extract_fit_parsnip() |>

tidy()I will visualise this via a bar chart to observe my significant features:

Use fitted logistic regression model to predict on test set

We are going to now append our predictions from our model we created as a baseline to append to the predictions we already have in the predictions data frame:

testing_lr_fit_probs <- predict(lr_fit, test, type='prob')

testing_lr_fit_class <- predict(lr_fit, test)

predictions<- cbind(test, testing_lr_fit_probs, testing_lr_fit_class)

predictions <- predictions |>

dplyr::mutate(log_reg_model_pred=.pred_class,

log_reg_model_prob=.pred_1) |>

dplyr::select(everything(), -c(.pred_class, .pred_0)) |>

dplyr::mutate(log_reg_class_custom = ifelse(log_reg_model_prob >0.7,"Yes","No")) |>

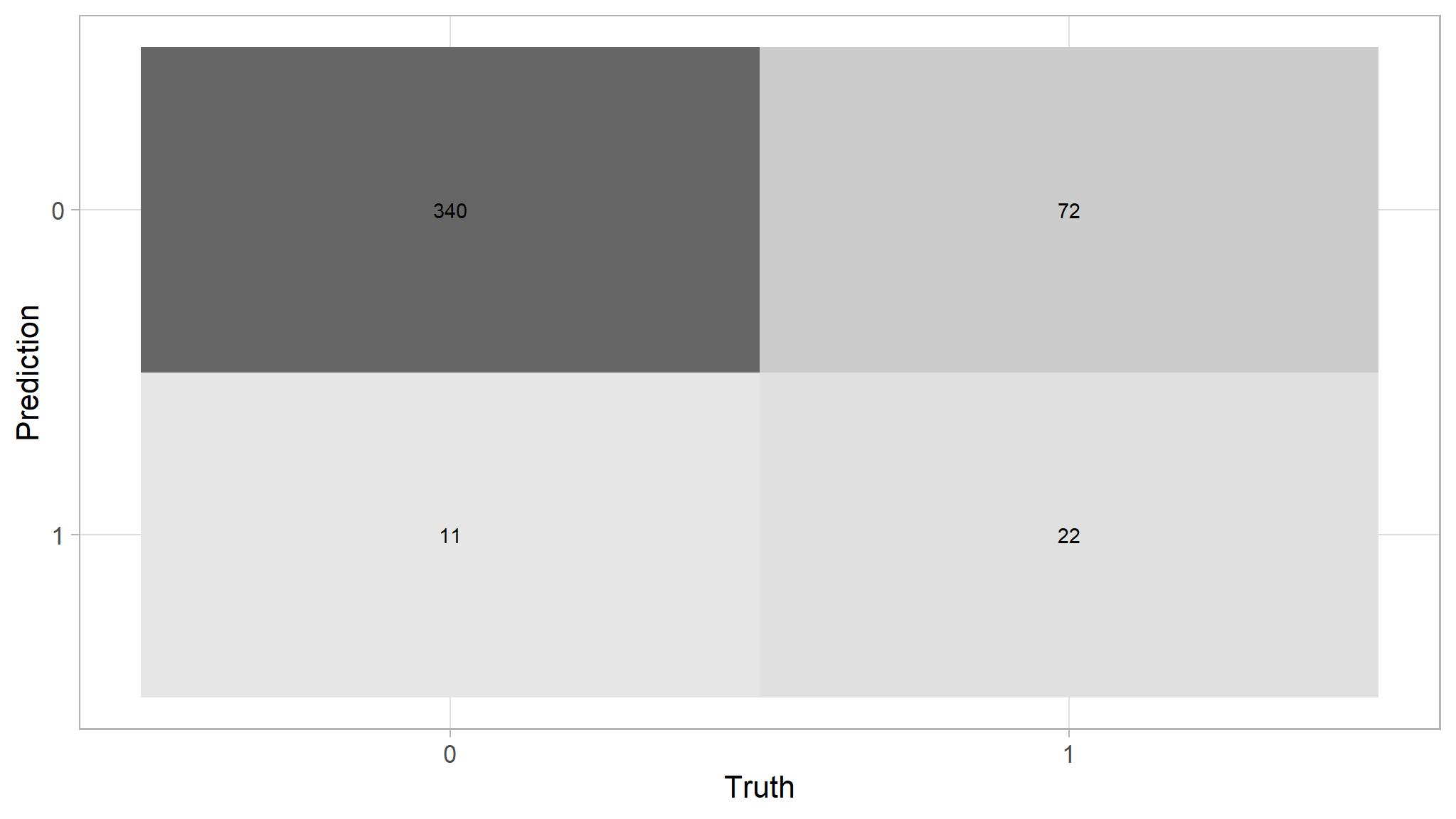

dplyr::select(-.pred_1)Confusion matrix

predictions |>

conf_mat(purchase,log_reg_model_pred)

#> Truth

#> Prediction 0 1

#> 0 340 72

#> 1 11 22predictions |>

conf_mat(purchase,log_reg_model_pred) |>

autoplot(type="heatmap")

initialise a GAM model

log_mod_gam <- gen_additive_mod() |>

set_engine('mgcv',method="REML") |>

set_mode("classification")add to workflow

Extracting the fitted data

I want to pull the data fits into a tibble I can explore. This can be done below:

lr_fitted <- lr_fit |>

tidy()I will visualise this via a bar chart to observe my significant features:

Use fitted logistic regression model to predict on test set

We are going to now append our predictions from our model we created as a baseline to append to the predictions we already have in the predictions data frame:

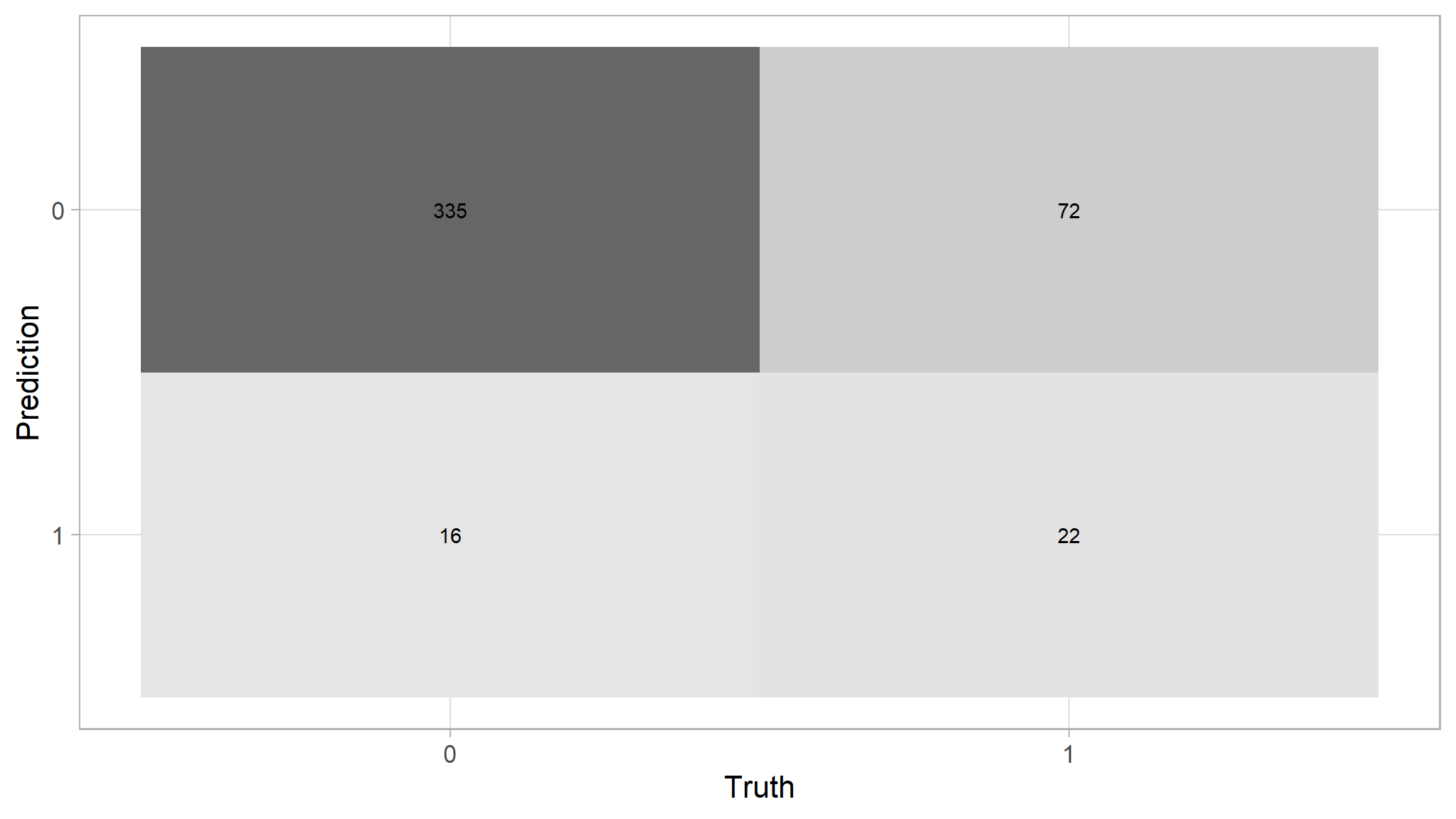

predictions |>

conf_mat(purchase,log_reg_model_pred)

#> Truth

#> Prediction 0 1

#> 0 335 72

#> 1 16 22predictions |>

conf_mat(purchase,log_reg_model_pred) |>

autoplot(type="heatmap")

- The generalised Additive logistic regression performs a bit poor than the glm

- the difference is just one percent accuracy